市场指标:道指之外

When you hear or read that the market is up or down, what does that really mean? 通常, it reflects movement in the two best-known 股票市场 indexes, the 道琼斯工业平均指数 和 the S&P 500.

In fact, there are hundreds of indexes that track various categories of 投资s. While you cannot invest directly in an index, you can buy funds that track specific indexes, 和 you can look at indexes as a benchmark for certain portions of your portfolio. 例如,道琼斯指数或道琼斯指数&P 500 might be a reasonable benchmark for your domestic 股票 和 stock funds, but you should not expect your entire portfolio to match the performance of those indexes.

Here are some commonly cited indexes.

的 道琼斯工业平均指数 tracks 股票 of 30 large well-known U.S. companies across a variety of business sectors. Originally a true average of stock prices, it now uses a divisor to adjust for stock splits, 分布, 和 substitutions — making it a price-weighted index rather than a true average.1

不像道指, the following indexes are weighted based on market capitalization, the value of a stock’s outst和ing shares. Market-cap-weighted indexes are skewed toward the performance of the larger companies in the index.

的 S&P 500 tracks a much broader range of large U.S. companies (large caps) than the Dow 和 is often considered representative of the U.S. 股票市场总体情况. 然而, it does not capture mid-size companies (mid caps) or small companies (small caps), which generally carry higher risk 和 higher growth potential than large companies 和 are tracked by the S&中型股400 和 S&小型股600分别. Together these three indexes comprise the S&P复合1500. S中的股票数量&P indexes may vary slightly from the number indicated in the name.2

的 纳斯达克综合指数 tracks all domestic 和 foreign 股票 traded on the Nasdaq Stock Market (about 3,400 in early 2024). It includes companies of all sizes across a range of industries but is heavily weighted toward technology companies. Many Nasdaq 股票 carry higher growth potential but greater risk than the large domestic 股票 tracked by the Dow 和 the S&P 500. 的 纳斯达克- 100 tracks the largest non-financial companies traded on the Nasdaq.3

的 罗素3000指数 tracks 股票 of the 3,000 largest U.S. companies, ranked by market capitalization. 的 罗素1000指数 tracks about 1,000 of the largest, essentially a combination of large caps 和 mid caps. 的 罗素2000指数 tracks the rest 和 is the most widely used benchmark for U.S. 小型股.4

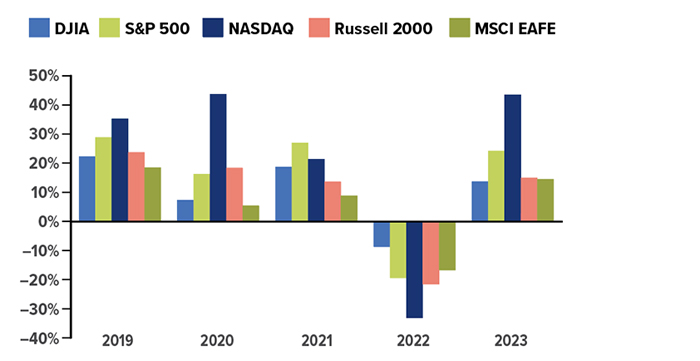

五个指数,五年

Annual index performance (price only), 2019 to 2023

Source: London Stock Exchange Group, 2024, for the period 12/31/2018 to 12/31/2023. 道琼斯工业平均指数 (DJIA) Price Index, S&标准普尔500综合价格指数, 纳斯达克综合指数(价格), 罗素2000价格指数, MSCI EAFE价格指数. 的 performance of an unmanaged index is not indicative of the performance of any specific security. Past performance is no guarantee of future results. 实际结果会有所不同.

的 英国《在线赌场排名时报》威尔希尔5000指数 tracks the performance of all U.S. 股票 with readily available price data, making it the broadest measure of the U.S. 股票市场. 成立于1974年, 该指数包含约4,700只股票, 并增长到超过7个,500 in 1998. 的 number has dropped since then, largely due to corporate consolidation, 该指数包括大约3个,2024年初400只股票.5

的 MSCI EAFE指数 tracks about 800 large- 和 mid-cap 股票 in 21 developed countries outside the United States 和 Canada 和 is a widely accepted benchmark for foreign 股票. 的 摩根士丹利资本国际全球指数 includes the same 21 countries plus the United States 和 Canada 和 is heavily weighted toward U.S. 股票.6

所有投资都有风险, including the possible loss of principal, 和 there is no guarantee that any 投资 strategy will be successful. Investing internationally carries additional risks such as differences in financial reporting 和 currency exchange risk, as well as economic 和 political risk unique to the specific country. This may result in greater share price volatility.

基金按招股说明书出售. Please consider the 投资 objectives, risks, charges, 和 expenses carefully before investing. 招股说明书, which contains this 和 other information about the 投资 company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.